Decisions Under Uncertainty for Price Management

- Researcher: Asbjørn Nilsen Riseth

- Academic Supervisors: Jeff Dewynne and Chris Farmer

- Industrial Supervisor: Marco Brambilla

Background

Decisions can be made based on mathematical models that make forecasts of systems, such as decisions on product prices based on future sales forecasts. These forecasts can carry with them a description of the uncertainty in the model.  For example, future demand for a product can be modelled as a random variable with a given distribution. Because of this uncertainty, a particular decision can have infinitely many outcomes associated with it, so we must somehow take this into account in the decision process.

For example, future demand for a product can be modelled as a random variable with a given distribution. Because of this uncertainty, a particular decision can have infinitely many outcomes associated with it, so we must somehow take this into account in the decision process.

The decision process involves four broad categories, all of which are important for efficient decision making. These are: characterisation of the objective, modelling of the system, modelling of a decision-maker’s attitude to uncertainty, and numerical methods for solving the specified decision problem.

The main goal of this research project is to gain new insights and give recommendations on these categories, with a particular focus on pricing decisions for large retailers.

Outcomes

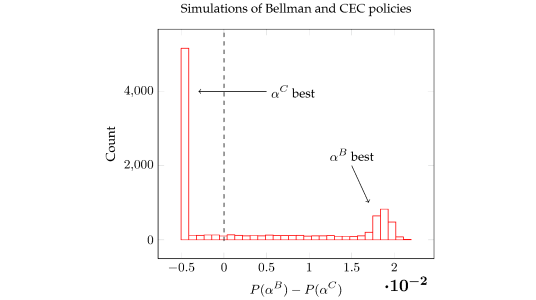

The work in this project is quite varied. One of the important aspects of models and systems with uncertainty is that the distribution of the random variable that is your objective carries crucial information for how to approach the problem. This is often neglected by academics and practitioners, and therefore much insight is lost for those who have to choose modelling and optimization approaches. We provide an example of such insights in our work on dynamic pricing decisions in discrete time [2].

The graph above shows the probability distribution of the difference in profit between two pricing strategies. Although one strategy is better in expectation (alphaB), it is not better in all cases; in fact, the other strategy is better more than 50% of the time. See [2] for details.

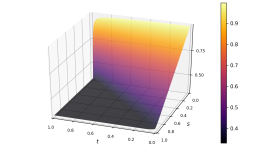

On the topic of modelling of the system, we have proposed a novel algorithm for parameter estimation for stochastic differential equations [3], and a continuum model for dynamic pricing of products where the optimal pricing strategy can be found from the solution of a nonlinear partial differential equation [4].

All decisions we consider will in practice result in high-dimensional optimisation problems. It is therefore important to have efficient algorithms for solving such problems. As part of this research project, we have developed a novel acceleration technique that can be applied to existing optimisation algorithms to improve their performance [1].

Publications

[1] A. N. Riseth. Objective acceleration for optimization. Submitted (2017).

[2] A. N. Riseth, J. N. Dewynne, and C. L. Farmer. A comparison of control strategies applied to a pricing problem in retail. Submitted (2017).

[3] A. N. Riseth and J. P. Taylor-King. Operator fitting for parameter estimation of stochastic differential equations. Submitted (2017).

[4] A. N. Riseth. Dynamic pricing in retail with diffusion process demand. Submitted (2017).