Bargaining Under Uncertainty

Researcher: Huining Yang

Researcher: Huining Yang- Academic Supervisor: Ben Hambly

- Industrial Supervisor: Paul Barnes, Amr El Zanfally

Background

The classical bargaining problem is where a buyer and a seller must agree on the value of a project. Each party has a reservation price; the buyer knows the maximum they are willing to pay for the project and the seller knows the minimum they are willing to accept. A key question is to determine a party’s optimal bidding strategy to secure the project along with the best price that can be achieved.

The goal of this project is to develop a theoretical framework and a numerical implementation for some models for bargaining. BP has many contracts under negotiation at any time and the aim is to develop mathematical tools that assist in negotiations and decision making. In parallel with understanding and developing the theory, we also analyse data coming from negotiations from various parts of BP. This ensures that we keep the theoretical ideas close to the industrial drivers. We explore different optimality criteria and the different data that may be relevant to bargaining in this multidimensional situation.

Progress

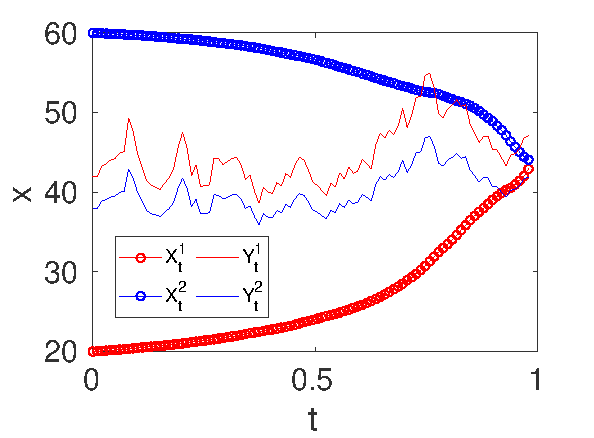

We have built a continuous-time bargaining model based on stochastic differential games and found the optimal strategies for both players by solving a Hamilton-Jacobi-Bellman (HJB) equation. We consider the situation where the two parties negotiate over a project in order to find a single price for it in a finite time horizon, and we assume that they have different but highly correlated valuations of the project, which can be regarded as their reservation prices. Their offers approach their reservation prices near the deadline. The randomness in the valuation processes is modeled by Brownian motion. We translate the bargaining game into a cost minimisation problem, where each player's cost is determined by how far they are from making a deal and their rate of concession as the deadline for a deal approaches. We show an example in Figure 1, where the significant change in the valuation processes impact the player’s offers in this particular simulation.

Figure 1: Numerical solution to the bargaining model, where $ X_t^1$ and $X_t^2$ respectively denote the offers of the buyer and the seller, and $Y_t^1$ and $Y_t^2$ respectively denote their valuations of the project.

Future Work

The next step would be to look at the case with incomplete information, i.e., when a party only has limited information about some model parameters, which are associated with their opponent and/or the dynamics. The key question is how to estimate those parameters and how to construct optimal strategies with incomplete information. It would also be interesting to explore the multi-dimensional problem when parties negotiate over several items or quantities.