High Ericksen number and the dynamical creation of defects in nematics

Abstract

We consider the Beris-Edwards model of liquid crystal dynamics. We study a non-dimensionalisation and regime suited for the study of defect patterns, that amounts to a combined high Ericksen and high Reynolds number regime.

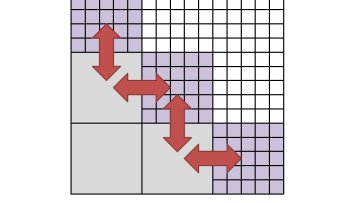

We identify some of the flow mechanisms responsible for the appearance of localized gradients that increase in time.

This is joint work with Hao Wu (Fudan).