Oxford Mathematics Open Day Live Stream - 3 July

On 3 July we shall we live streaming our Open Day for prospective applicants as part of our going Behind the Scenes' at Oxford Mathematics. This is our way of making the Open Day 'open' to everyone, wherever you are.

The running order:

10.00am - James Munro introduces you to Mathematics at Oxford

10.30am - Vicky Neale on Pure Mathematics at Oxford

11.00am - Dominic Vella on Applied Mathematics at Oxford

AND

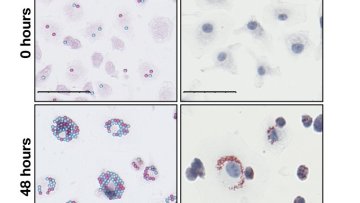

Certain inflammatory and infectious diseases, including atherosclerosis and tuberculosis, are caused by the accumulation inside immune cells of harmful substances, such as lipids and bacteria. A multidisciplinary study published in Proceedings B of the Royal Society, by researchers from the Universities of Oxford and Sydney, has shown how cell cannibalism contributes to this process.

From knots to homotopy theory

Note: unusual time!

Abstract

Knots and their groups are a traditional topic of geometric topology. In this talk, I will explain how aspects of the subject can be approached as a homotopy theorist, rephrasing old results and leading to new ones. Part of this reports on joint work with Tyler Lawson.

A neural network approach to SLV Calibration

Abstract

A central task in modeling, which has to be performed each day in banks and financial institutions, is to calibrate models to market and historical data. So far the choice which models should be used was not only driven by their capacity of capturing empirically the observed market features well, but rather by computational tractability considerations. Due to recent work in the context of machine learning, this notion of tractability has changed significantly. In this work, we show how a neural network approach can be applied to the calibration of (multivariate) local stochastic volatility models. We will see how an efficient calibration is possible without the need of interpolation methods for the financial data. Joint work with Christa Cuchiero and Josef Teichmann.