Mathemalchemy: a mathematical and artistic adventure - Ingrid Daubechies

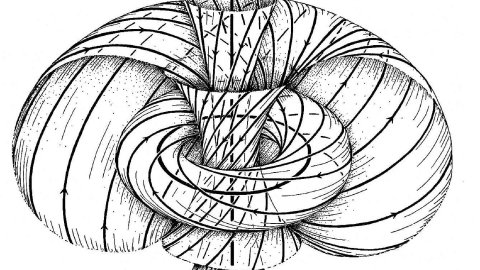

A collaborative art installation celebrating the joy, creativity and beauty of mathematics has been in the works for the past two years, and will soon be ready to emerge from its long gestation. The original idea, conceived by textile artist Dominique Ehrmann and mathematician Ingrid Daubechies inspired a team of 24 Mathemalchemists to work together, transforming the whole conception in the process, and bringing their individual expertise and whimsy to a large installation.

Despite the challenges of Covid-19, the team created a fantasy world where herons haul up nets loaded with special knots in the Knotical scene, a tortoise meditates while ambling along Zeno's path, chipmunks and squirrels ponder the mysteries of prime numbers, and a cat named Arnold bakes cookies that tile the plane in the Mandelbrot bakery; and a myriad more mathematical ideas swirl through the air.

This presentation will introduce some of the ideas and components, and show the team at work. Here's a sneak preview:

www.mathemalchemy.org

@mathemalchemy

Multi-award winning Ingrid Daubechies is James B. Duke Distinguished Professor of Mathematics and Electrical and Computer Engineering at Duke University.

Watch (no need to register and it will remain available after broadcast):

Oxford Mathematics YouTube

The Oxford Mathematics Public Lectures are generously supported by XTX Markets.

[[{"fid":"62753","view_mode":"media_397x223","fields":{"format":"media_397x223","field_file_image_alt_text[und][0][value]":false,"field_file_image_title_text[und][0][value]":false},"type":"media","field_deltas":{"1":{"format":"media_397x223","field_file_image_alt_text[und][0][value]":false,"field_file_image_title_text[und][0][value]":false}},"attributes":{"class":"media-element file-media-397x223","data-delta":"1"}}]]

11:30

Compressible types in NIP theories

Abstract

I will discuss compressible types and relate them to uniform definability of types over finite sets (UDTFS), to uniformity of honest definitions and to the construction of compressible models in the context of (local) NIP. All notions will be defined during the talk.

Joint with Martin Bays and Pierre Simon.

Congratulations to Professor Alison Etheridge FRS who has been appointed as the new Chair of the Council for the Mathematical Sciences which represents the whole breadth of the mathematical sciences in the UK, with input from the Institute of Mathematics and its Applications (IMA), the London Mathematical Society (LMS), the Royal Statistical Society (RSS), the Edinburgh Mathematical Society (EMS) and the Operational Research Society (ORS).

12:45

Generalized entropy in topological string theory

Abstract

The holographic entanglement entropy formula identifies the generalized entropy of the bulk AdS spacetime with the entanglement entropy of the boundary CFT. However the bulk microstate interpretation of the generalized entropy remains poorly understood. Progress along this direction requires understanding how to define Hilbert space factorization and entanglement entropy in the bulk closed string theory. As a toy model for AdS/CFT, we study the entanglement entropy of closed strings in the topological A model, which enjoys a gauge-string duality. We define a notion of generalized entropy for closed strings on the resolved conifold using the replica trick. As in AdS/CFT, we find this is dual to (defect) entanglement entropy in the dual Chern Simons gauge theory. Our main result is a bulk microstate interpretation of generalized entropy in terms of open strings and their edge modes, which we identify as entanglement branes.

More precisely, we give a self consistent factorization of the closed string Hilbert space which introduces open string edge modes transforming under a q-deformed surface symmetry group. Compatibility with this symmetry requires a q-deformed definition of entanglement entropy. Using the topological vertex formalism, we define the Hartle Hawking state for the resolved conifold and compute its q-deformed entropy directly from the reduced density matrix. We show that this is the same as the generalized entropy. Finally, we relate non local aspects of our factorization map to analogous phenomenon recently found in JT gravity.