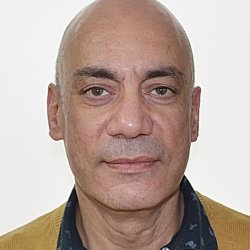

Prof. Michael Monoyios

Associate Professor in Financial Mathematics; Tutorial Fellow in Applied Mathematics at Lady Margaret Hall

University of Oxford

Andrew Wiles Building

Radcliffe Observatory Quarter

Woodstock Road

Oxford

OX2 6GG

Neural functionally generated portfolios (June 2025) (with Olivia Pricilia)

Stability of the Epstein-Zin problem, Mathematical Finance 34 (No. 4) (2024) 1263-1290 (with Oleksii Mostovyi)

Duality for optimal consumption under no unbounded profit with bounded risk, Annals of Applied Probability 32 (No. 5) (2022) 3572-3613

Duality for optimal consumption with randomly terminating income, Mathematical Finance 31 (2021) 1275-1314 (with Ashley Davey and Harry Zheng)

Infinite horizon utility maximisation from inter-temporal wealth (October 2020, first version August 2020)

Executive stock option exercise with full and partial information on a drift change point, SIAM Journal on Financial Mathematics 11 (2020) 1007-1062 (with Vicky Henderson, Kamil Kladivko and Christoph Reisinger)

Optimal exercise of an executive stock option by an insider International Journal of Theoretical and Applied Finance 14 (2011) 83-106 (With Andrew Ng)

Optimal investment with inside information and parameter uncertainty Mathematics and Financial Economics 3 (2010) 13-38 (With Albina Danilova and Andrew Ng)

Utility-based valuation and hedging of basis risk with partial information Applied Mathematical Finance 17 (2010) 519-551

Optimal investment and hedging under partial and inside information. In Advanced Financial Modelling, H. Albrecher, W. J. Runggaldier and W. Schachermayer (eds.) Radon Series on Computational and Applied Mathematics 8 (2009) 371-410

Utility indifference pricing with market incompleteness, in: Nonlinear Models in Mathematical Finance: New Research Trends in Option Pricing (ed. Ehrhardt M) (2008) Nova Science Publishers, Hauppage, New York

Optimal hedging and parameter uncertainty IMA Journal of Management Mathematics 18 (2007) 331-351

The minimal entropy measure and an Esscher transform in an incomplete market model Statistics and Probability Letters 77 (2007) 1070-1076

Characterisation of optimal dual measures via distortion Decisions in Economics and Finance 29 (2006) 95-119

Performance of utility-based strategies for hedging basis risk Quantitative Finance 4 (2004) 245-255

Option pricing with transaction costs using a Markov chain approximation Journal of Economic Dynamics and Control 28 (2004) 889-913

Efficient option pricing with transaction costs Journal of Computational Finance 7 (2003) 107-128

I have taught various courses in stochastic calculus, portfolio optimisation, and derivative valuation. Courses have included: stochastic calculus; stochastic control; advanced volatility modelling; asset pricing and portfolio theory; stochastic control and dynamic asset allocation; mathematical models of financial derivatives; binomial models and discrete martingales; utility and portfolio theory; stochastic integration; stochastic optimisation; stochastic volatility; valuation, hedging and investment in incomplete markets; introduction to probability. I have given classes in martingales through measure theory and mathematical models of financial derivatives. I tutor Applied Mathematics to undergraduates at my college, Lady Margaret Hall.

Leverhulme Research Fellow, 2004-2005

University of Oxford Teaching Award, 2007

Departmental Teaching Award, 2014

I am an Associate Professor in Mathematical Finance and a Fellow of Lady Margaret Hall.

I obtained BSc Physics and PhD Theoretical Physics degrees fromImperial College, London, 1983--1989. I was a Royal Society Postdoctoral Fellow in Theoretical Physics at the Niels Bohr Institute, Copenhagen, 1989-1990. From 1990 to 1992 I was a trader of interest rate derivatives for Security Pacific Hoare Govett, London. I returned to academia as a Research Associate at Imperial College, 1993-1995. From 1996-2004 I was at Brunel University as a Senior Lecturer in Mathematical Finance.

In 2004-2005 I held a Leverhulme Research Fellowship, and in 2005 I participated in and co-organised seminars at the Isaac Newton Institute Programme in Developments in Quantitative Finance. In October 2005 I joined the Mathematical Institute at Oxford. I was principal organiser of the workshop Further Developments in Quantitative Finance, held at the International Centre for Mathematical Sciences, Edinburgh, in July 2007. In 2011 I organised a London Mathematical Society Short Course on Duality, Malliavin Calculus and BSDEs in Mathematical Finance.

My research has focussed on applications of stochastic control to optimal investment, consumption and and hedging in incomplete markets. I have worked on problems involving transaction costs, basis risk, and partial and inside information. Other interests include pathwise hedging, stochastic portfolio theory, and asymptotic methods. For more details visit my webpage