Prof. Jan Obloj

Professor of Mathematics

Fellow and Tutor in Mathematics at St John's College

University of Oxford

Andrew Wiles Building

Radcliffe Observatory Quarter

Woodstock Road

Oxford

OX2 6GG

My complete list of Publications is available here. Recent preprints include:

- With M. Hasenbichler, B. Joseph, G. Loeper and G. Pammer, The Martingale Sinkhorn Algorithm, 2025.

- With I. Guo, Robust Pricing and Hedging of American Options in Continuous Time, 2025.

- with Y. Jiang, Sensitivity of causal distributionally robust optimization, 2024.

I work in the Mathematical and Computational Finance and Stochastic Analysis research groups at the Mathematical Institute, am an Official Fellow of St John's College and a member of the Oxford-Man Institute of Quantitative Finance. Before coming to Oxford I was a Marie Curie Post-Doctoral Fellow at Imperial College London. I hold a Ph.D. degree in Mathematics from University Paris VI and Warsaw University.

I have a general interest in mathematics of randomness. Most of my research sits at the crossroads of various fields, including: probability theory, statistics, mathematical finance, operations research, optimal transport and data science. A lot of my research is related to problems in mathematical finance and my main focus is on robustness of the modelling pathways from input out outputs, ways to understand and quantify it. My research spans the spectrum from theoretical foundations of robust pricing and hedging paradigm in mathematical finance, to practical questions of building fast generic ways to approximate adversarial robustness of deep neural networks. A significant part of my recent research involves techniques from optimal transport (OT), in particular in relation to the martingale OT problem and adapted OT, as I find these problems endlessly fascinating and beautiful.

Selection of research talks online:

RiO Conference 2020, CMO-BIRS Workshop 2018, RiO Conference 2018, CMO-BIRS Workshop 2017, CIRM 2017, CMO-BIRS Workshop 2016, BIRS Workshop 2014, SIAM FM 2014 Plenary Talk

General public talks and interviews online:

(in Polish)

Giełdy nie da się zhakować (in Polish)

Selection of undergraduate lectures available online:

Probability, Measure & Martingales: Filtrations, Martingales, Stopping, Inequalities.

Conferences in Oxford

My group organised a major Conference on Robust Techniques in Quantitative Finance in Oxford, 3-7 September 2018.

This follows on from a series of smaller workshop, including one on Martingale Optimal Transport in 2017, and one on Skorokhod Embeddings in 2016.

Miscellaneous:

The correct spelling of my last name in LaTeX is: Ob{\l}{\'o}j

Regrettably I cannot offer any student internships at the moment.

I regularly teach both undergraduate and graduate material, often related to probability theory and mathematical finance.

I gave several invited graduate courses on the Skorokhod embedding problem, (robust) financial mathematics, and optimal transport methods in mathematical finance. My old lecture notes on some of these topics are available here. Last year I gave an invited graduate course at ENSAE Paris. The Lecture notes are available here: l1, l2, l3, l4, l5, l6, MOT Slides, General Slides, DRO Slides, SOT Slides.

In November 2025 I was a Simons Fellow at the Isaac Newton Institute for Mathematical Sciences in Cambridge.

I was honoured to serve as the President of the Bachelier Finance Society in 2024-2025. I am currently its Past President and member of the Board of Directors.

I am immensely proud to have been awarded the 2022 Hugo Steinhaus Award by the Polish Mathematical Society.

Elected Fellow of the Institute of Mathematical Statistics, 2022.

International visitor, University of Sydney Mathematical Research Institute, 2019.

Recognition of Distinction, University of Oxford, 2015

ERC Starting Grant (335421-ROBUSTFINMATH), 2014-2018

Bruti-Liberati Fellow at the University of Technology Sydney, Australia, Dec 2011

Teaching Award, University of Oxford, 2010

Marie-Curie IntraEuropean Fellowship at Imperial College London, 2006-2008

I serve as an Associate Editor for

- Mathematical Finance

- Finance and Stochastic

- Stochastic Processes and their Applications

- SIAM Journal on Financial Mathemtics

I was a guest editor at the Mathematical Finance co-editing with Thaleia Zariphopoulou a special issue dediacted to the memory of Mark H.A. Davis.

In the past, I had the privilege to serve as an Associate Editor for Mathematical and Financial Economics and for Applied Mathematical Finance.

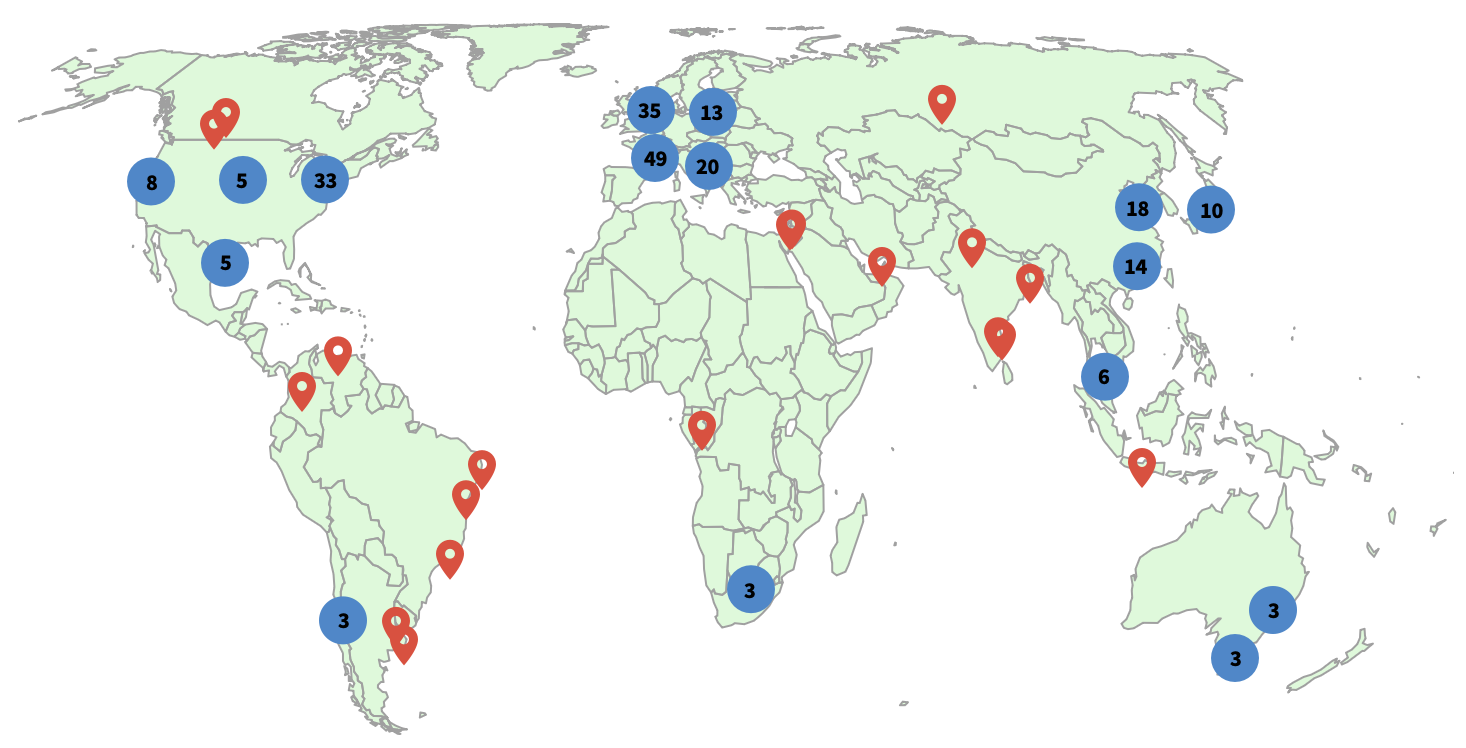

Fun map of research impact:

246 cities: each point corresponds to a different city with a research institution where the corresponding author of a paper citing my work is based (Source: Web of Science, January 2026).