Arbitrage-free market model

Background

Arbitrage refers to positive probabilities of earning risk-free profits with a costless trading strategy. For an exchange market and a central clearing house like CME, it is crucial to ensure its settlement prices of financial derivatives to be free of arbitrage for a fair valuation benchmark. In addition, from a risk management perspective, it is key to generate arbitrage-free risk scenarios.

As a result, we have two goals to achieve in this project. First, we derive no-arbitrage conditions, and investigate if those conditions are violated by observed prices data of traded options. In case of violation, we design an optimal perturbation method to cleanse data that allows no arbitrage. Second, we seek for a generic class of continuous-time diffusion processes to model the joint dynamics of observed prices, subject to no-arbitrage conditions. Thereafter, we aim to make inferences on the diffusion processes using discretely observed sample paths and deep learning techniques. The processes learned from market data can then be used to simulate satisfactory risk scenarios.

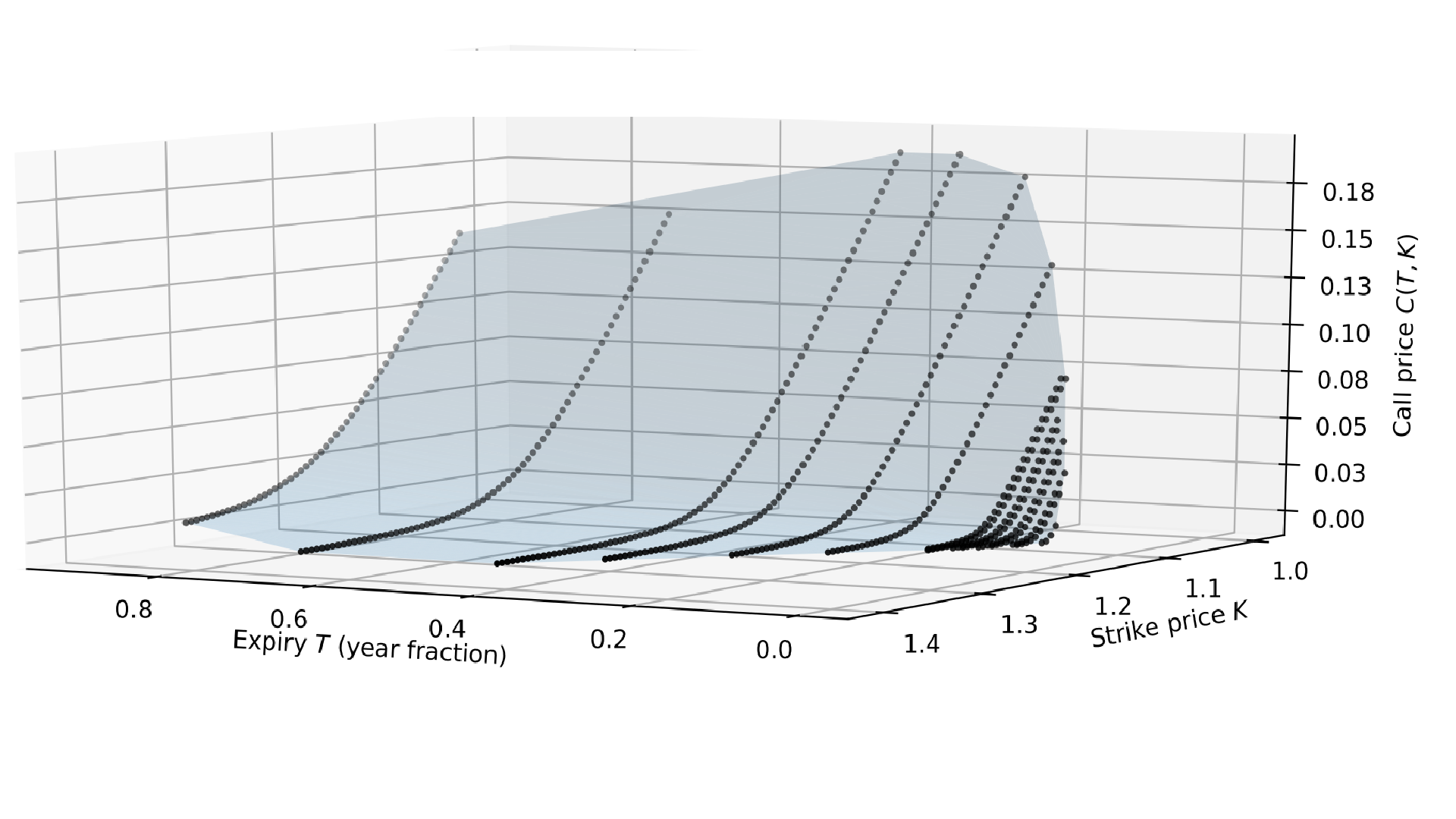

Figure 1. A collection of prices for EURUSD European call options observed as of 12th July, 2018. Is there any arbitrage opportunity? If yes, how can we perturb prices to give an arbitrage-free model?

Progress

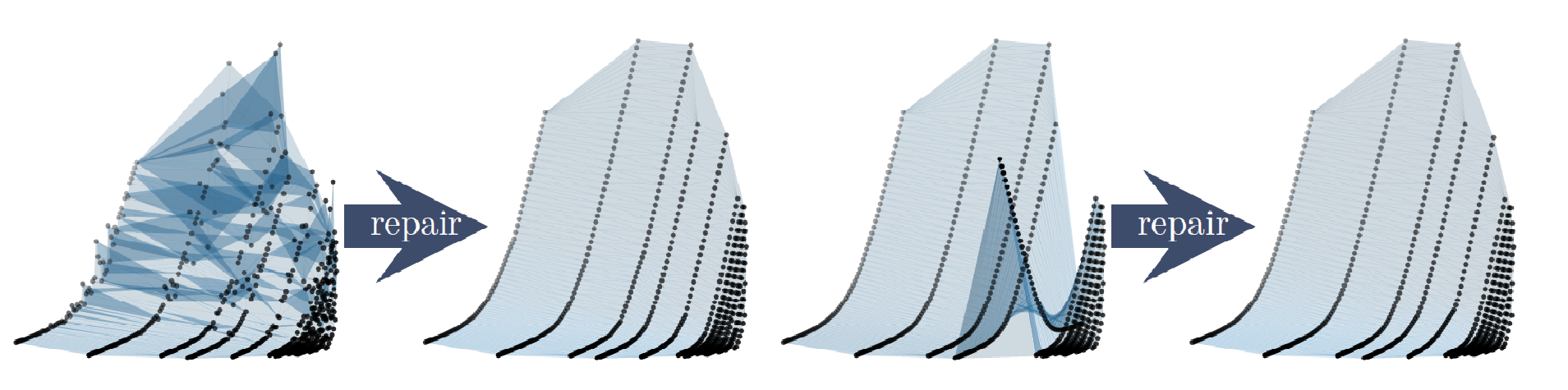

We have derived a set of linear constraints of prices that is sufficient and necessary for no-static-arbitrage. In case of violations to these constraints, we have designed a constrained linear programming problem to repair arbitrageable prices. In addition, we also consider liquidity profiles of traded options, i.e, bid-ask price information, to allow different levels of freedom to perturb prices.

Figure 2. Some examples of repairing arbitrageable prices.

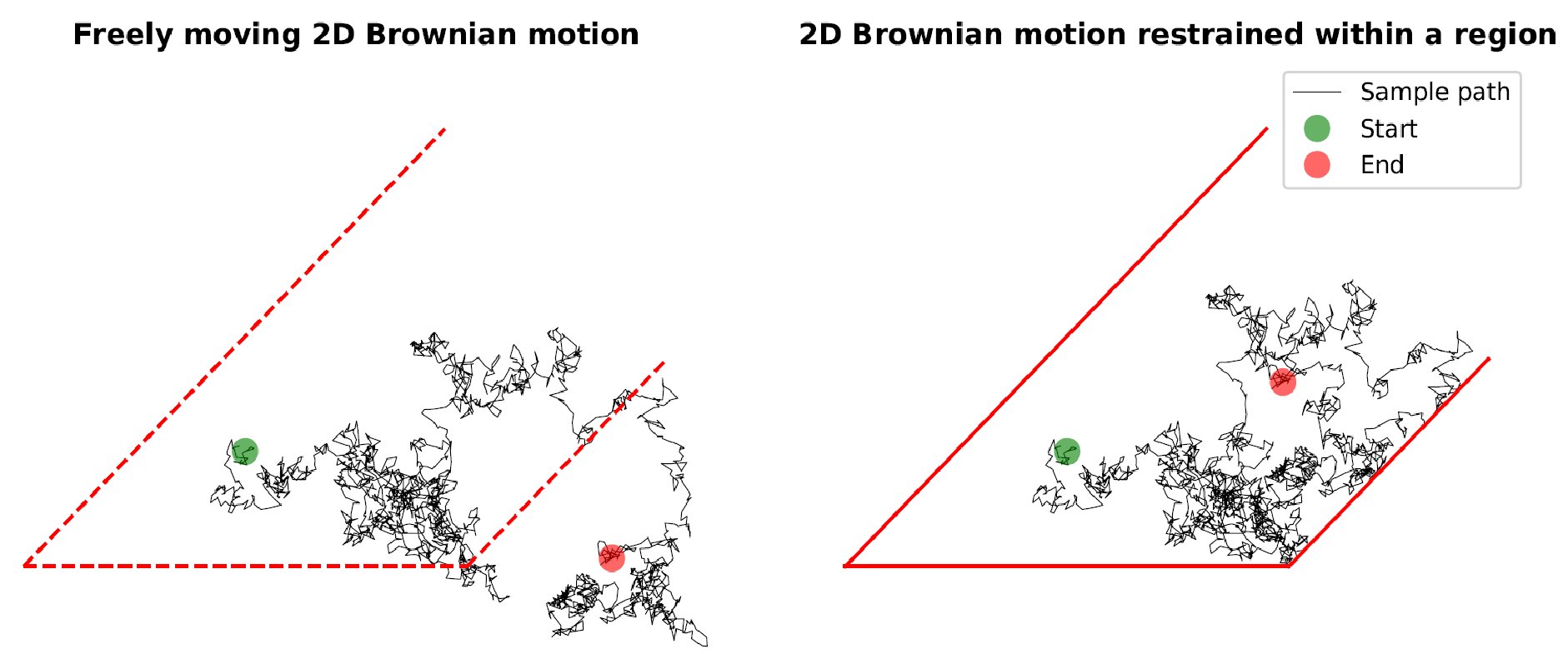

A good formulation of no-arbitrage conditions allows us to impose explicit restrictions on a generic diffusion process if to be used to model dynamics of prices. A diffusion process is a continuous-time random process which is Markovian (memoryless). If we view the price array of all traded assets as a diffusion particle in a high-dimensional space, then our no-arbitrage constraints define a polytope in the space. An arbitrage-free diffusion particle is always trapped within the polytope. The challenge is to restrict the behaviors of such diffusion close to the boundary of the polytope. This is achieved by restraining the drift (controls the velocity of the particle) and covariance (controls the random movement of the particle) of the diffusion.

Figure 3. Sample paths for two 2-dimensional Brownian motions, one is allowed to move freely (left), and the other one is restrained within a no-arbitrage polytope (right).

Outcomes

Having configured a class of no-arbitrage diffusion processes, we estimate the drift and covariance of the diffusion process from discretely observed sample paths, in other words, time series of price data. We formulate this estimation as a constrained optimization problem, where the constraints are no-arbitrage conditions. We take advantage of deep learning techniques to solve the problem efficiently.

Publications

S. Cohen, C. Reisinger and S. Wang. Detecting and repairing arbitrage in traded option prices. Applied Mathematical Finance. 2020, Vol.27, NO.4, 288-316. https://www.tandfonline.com/eprint/YQKWWNED73HSPVGC5ZBE/full?target=10.1080/1350486X.2020.1846573

S. Cohen, C. Reisinger and S. Wang. Arbitrage-free neural-SDE market models. arXiv. 2021, https://arxiv.org/abs/2105.11053.